Not long ago, I visited a large manufacturer that had over four automatic stretch wrapping machines on loan. The deal seemed simple: they received the machines for "free," as long as they purchased all their stretch wrap from the supplier that provided the equipment. At first glance, it might have looked like a great deal—but in reality, it was anything but. Unfortunately, the previous management had already signed up for this so-called "bargain."

The Problems with These Agreements

At first, the idea of getting expensive machinery without an upfront cost can be tempting. However, these agreements come with several major downsides:

-

You Will Pay More for the Stretch Wrap

If a supplier gives you $100,000 worth of equipment, they will make their money back somewhere. That "somewhere" is the cost of the stretch wrap. You’ll end up paying significantly more per roll than if you had purchased it on the open market. -

You Don’t Own the Machines

After a few years, you might think that you've spent the equivalent of the machine’s purchase price in stretch wrap costs—so you must own the equipment now, right? Wrong. Unless your contract explicitly states that ownership transfers to you, the supplier still owns the machines. That means when the agreement ends, you’re left with nothing.

The Bigger Issue: Dishonest Suppliers

In addition to these financial pitfalls, some suppliers take things even further. The manufacturer I visited had a serious issue—they couldn’t change any of the wrapping settings on their machines.

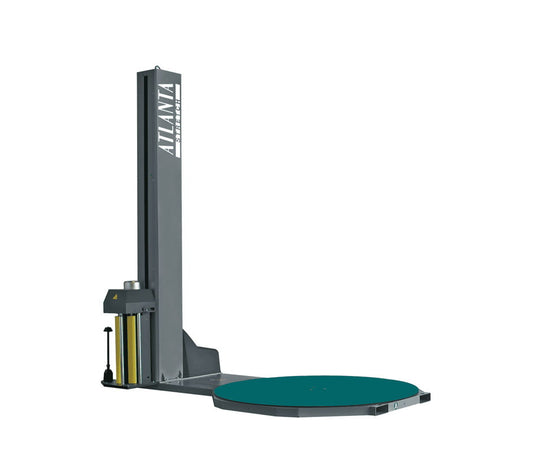

Since I was familiar with this particular Italian brand of machine having sold hundreds of them as their former distributors, I thought the customer was just looking in the wrong place. But after inspecting the machines myself, I found that the supplier had locked them out of the "cycle parameters." I tried all the standard default passwords—no luck. The supplier had changed the password to a custom one, preventing the customer from adjusting the settings. Worse still, they had increased the wrap amounts significantly, forcing the company to use more stretch wrap than necessary and in turn buy more stretchwrap from them

This is next-level deception.

The Lack of Industry Regulation

Unfortunately, organizations like the ACCC have done little to address these predatory agreements. That means the responsibility falls on businesses to protect themselves. If you have been a victim of this blatant scam, we urge you to report it to the ACCC, perhaps with enough reports they might pull their fingers out and take action.

What You Should Do Instead

If you need wrapping equipment but don’t have the cash to buy it outright, consider financing instead of entering into a supplier lock-in agreement. The lending industry is more regulated, and most importantly, you will own the machine. That gives you the freedom to buy stretch wrap from any supplier at competitive market rates.

At the end of the day, control over your equipment and supply costs is crucial for maintaining a profitable and efficient operation. Don't fall into the trap of agreements that seem too good to be true—because they usually are.